Polyflow Overview

A PayFi Protocol Linking Real World Assets with DeFi

Why PayFi?

Payment is the leading application for we crypto and needs a new infra to handle compliance challenges, custodian risks, AML implementations as well as new crypto assets

DeFi needs a new infra for new yield source, compliance friendly and real world asset integration

Payment + DeFi = PayFi

Both of them need a new infrastructure layer —> PolyFlow

PolyFlow’s PayFi Solution

The fusion of crypto payments and DeFi has given rise to PayFi. PayFi seeks an entirely new infrastructure to support its implementation and address complex compliance issues. Since Solana Foundation Chair Lily Liu introduced the concept of PayFi at the Hong Kong Web3 Summit, PolyFlow has been regarded as one of the pioneering protocols aimed at constructing the financial infrastructure for PayFi.

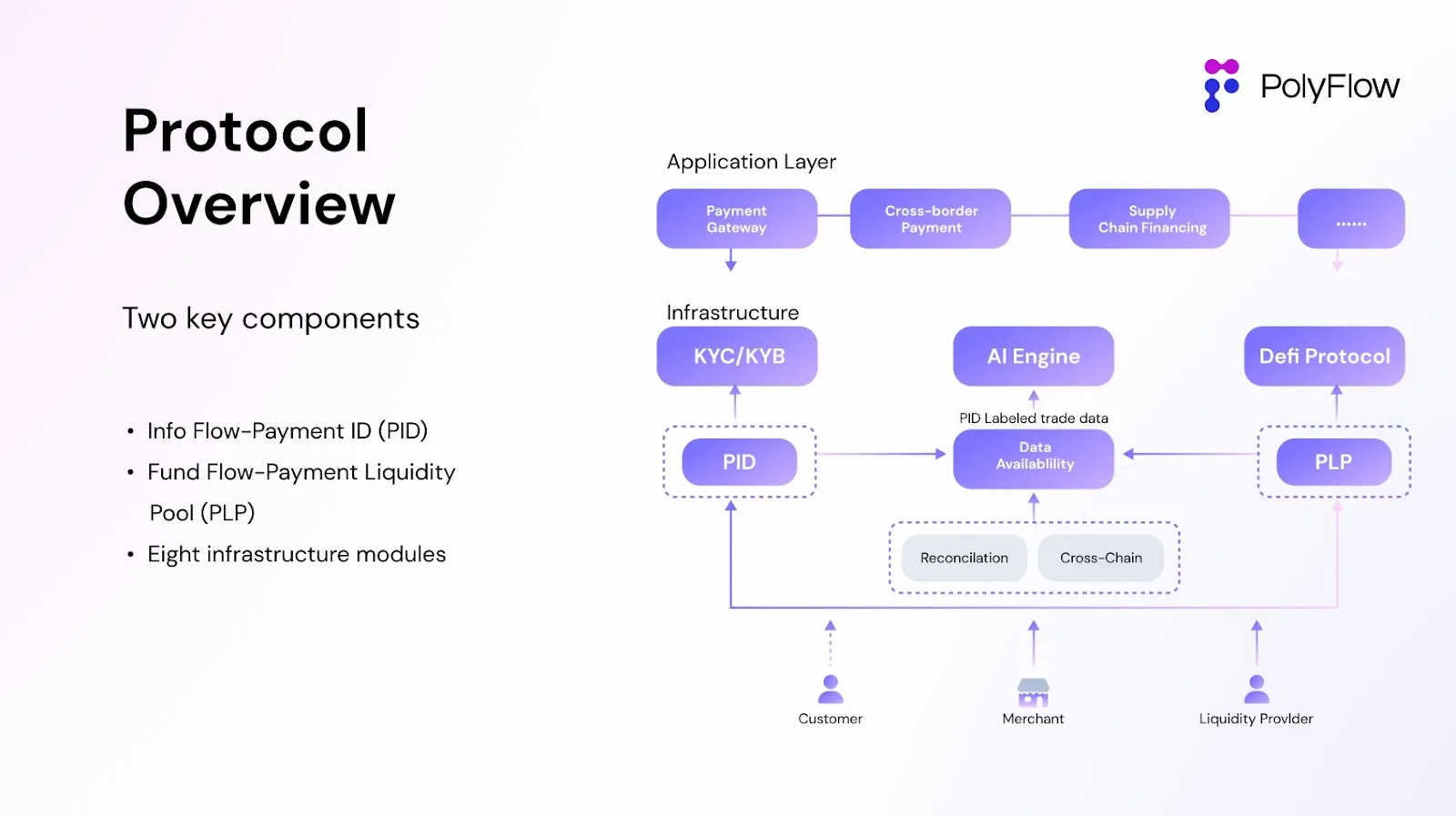

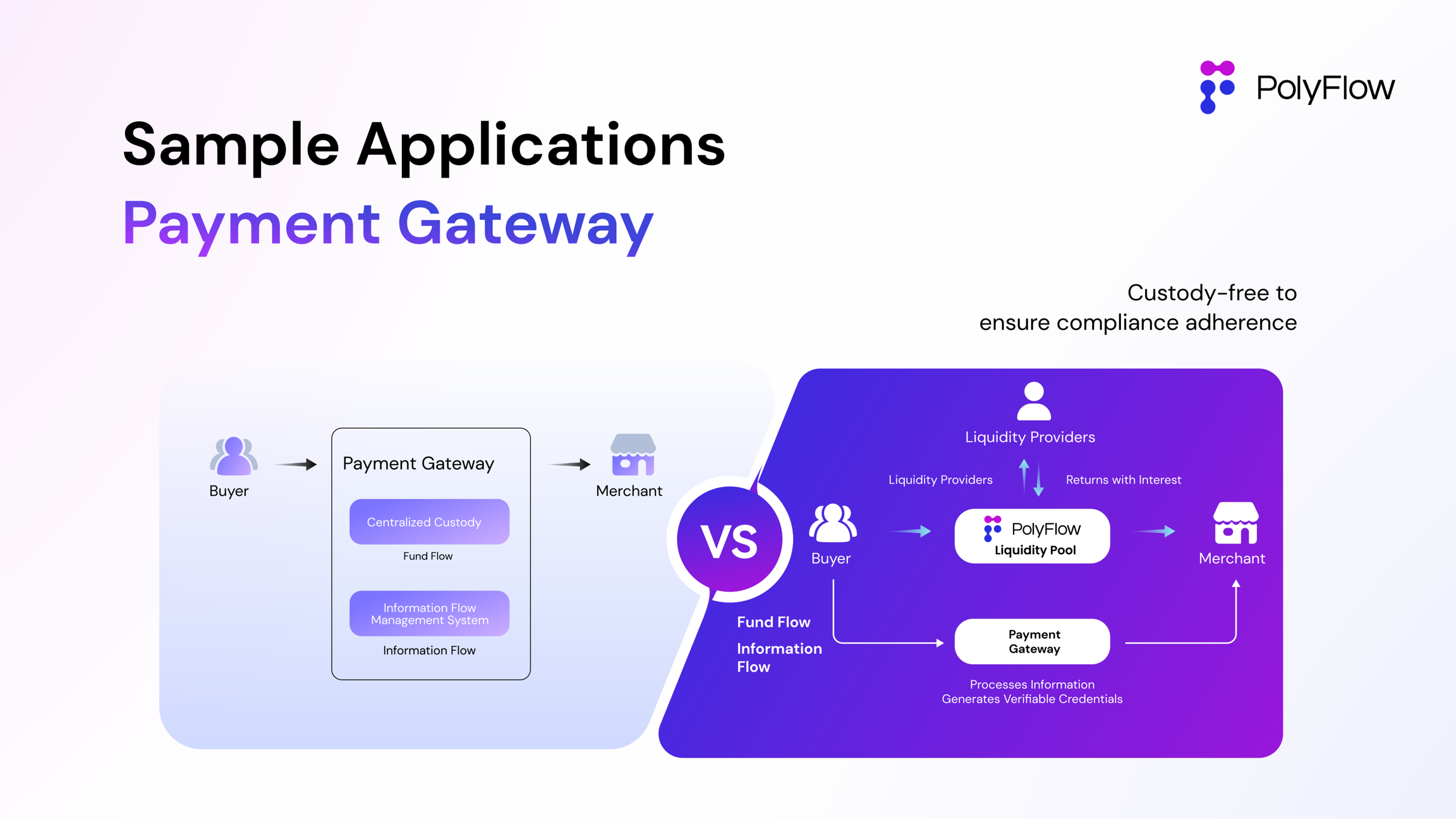

PolyFlow’s core concept revolves around modular design, decoupling the transaction information flow and fund flow previously controlled by centralized institutions. By doing so in a decentralized manner, it enhances compliance with regulatory standards and reduces custody risks throughout the transaction process. Additionally, PolyFlow leverages blockchain features to connect with the DeFi ecosystem, facilitating the widespread adoption of PayFi applications.

The Current Dilemmas Encountered in Cryptocurrency Payments

In the current business model of crypto payments, whether it’s payment solution providers or asset management service providers, most operate in a centralized manner. These centralized institutions lack transparency, and the risk between trading counterparts can easily lead to single points of failure. Additionally, centralized decision-making contributes to widespread custodial risks. These issues have long plagued the industry, adding significant complexity to transactions and causing concern for regulatory agencies:

Centralized custody: Institutions holding user-related private keys exposing user assets to significant custody risks.

Traditional fiat settlement: The current crypto payment model is transitional and must be integrated with traditional fiat settlement systems, resulting in increased costs and inefficiency.

Regulatory blind spots: Opaque centralized institutions, coupled with incomplete cryptocurrency legal frameworks, pose significant challenges for regulation.

Service limitations: Single institutions supporting limited categories of cryptocurrency payment services struggle to meet diverse user needs.

DeFi incompatibility: Centralized institutions cannot effectively integrate with the DeFi ecosystem, hindering widespread adoption of PayFi.

Some of the key features of Polyflow include:

A simpler gateway for crypto mass adoption

Custody-free to ensure compliance adherence

Privacy protection leveraging ZK (Zero-Knowledge) technology

DeFi yield generated by supplying liquidity for payment transactions

Proprietary PID Layer to facilitate cross-functional transactions

Comprehensive liquidity pool for settlement execution

Versatile Dapps to expand products and capabilities

What is a Payment Gateway?

A payment gateway is a secure online service that enables businesses to accept and process payments from customers using various payment methods like credit cards, debit cards, or digital wallets…

Official Website:https://app.polyflow.tech/

Twitter: https://x.com/Polyflow_PayFi

Medium:https://medium.com/@Polyflow

Mirror:https://mirror.xyz/polyflow.eth

Telegram:https://t.me/Polyflow_PID

Discord:https://discord.com/invite/9sR8yWktYm